Preparing for a New Year (2021) in Automotive

Preparing for a New Year (2021) in Automotive

For auto dealerships that followed the “double down in a recession” maxim, 2020 had the potential to become a case study in sales success. Naturally, a successful YOY result can only happen when dollars are invested in the right ways. That means this year’s winners didn’t spend just to spend.

Rather, they first addressed the new and fundamental challenges within the customer experience, caused by the pandemic. They acknowledged that shopper profiles had changed over night, and took the qualified risk to spend.

This article elaborates on how successful dealerships did that, despite everything the pandemic threw at them. As I’ll go into further detail below, the year provided plenty of opportunities to find customers and provide them the transportation they need, while delivering YOY growth. Getting there required a strategic shift in digital marketing and retailing, at a time when the instinct to cease all spending was remarkably and rightfully strong.

Headwinds

It’s true that demand for vehicles increased as we stopped traveling by air, school bussing ended and public transportation became unreliable. But dealership groups faced far stronger headwinds, not the least of which was mass unemployment and the deferment of large purchases it created.

Further, dealerships across the country closed their physical doors for varying periods of time, or implemented strict social distancing and appointment only policies. No matter how safe dealerships could make themselves, foot traffic was non-existent for many.

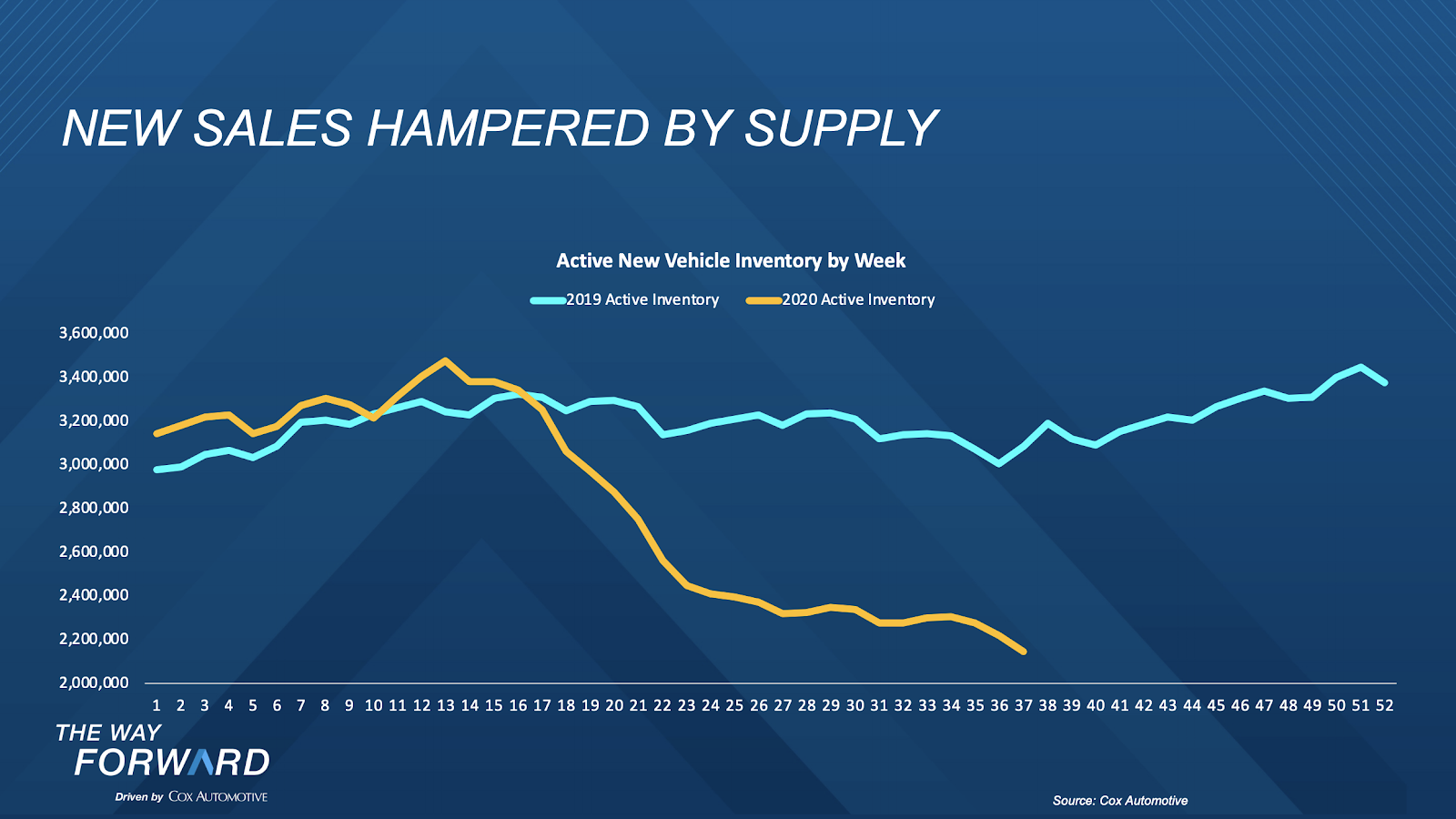

Adding to that, most major car manufacturers paused production and were unable to keep up with even typical market demand. Early on, dealers were understandably concerned about meeting sales goals, and through the manufacturers, were able to offer compelling financing and other discounts that moved most of their existing new inventory quickly and set record months for car sales. As a result, most dealers became severely limited or completely sold out of popular models by early summer. Inventory is now beginning to come to dealerships but the market continues to be severely constrained in being up to keep up with demand.

Progress

On May 22, 2020, Hertz filed for bankruptcy and flooded the used car auction market by dumping a large portion of their rental fleet, which were in turn bought by dealerships and sold as CPO or used. These vehicles maintained high price points and allowed dealers to grow their margins due to high demand.

But it didn’t make dealerships seem more inviting to the average concerned consumer. This caused many dealers to rethink the car buying experience, particularly how digital could chip away at easing customer concerns – and actually reduce the amount of in-person time required to make a purchase. Digital advertising and website experiences came into focus, with dealerships asking how a consumer might purchase a vehicle, without having to physically come to a dealership.

Solutions

One of the dealer groups Max Connect works with, Murdock Automotive Group, was hesitant to continue digital marketing efforts with COVID-19 restrictions and considered going dark for a time.

In the end, they chose not to because we rethought their digital strategy, virtual showroom and buying experience with new market realities in focus. Murdock agreed to put our plan in motion, and developed new pricing incentives.

We launched new campaigns and by April assisted Murdock Hyundai to become the #2 Hyundai dealer in the nation in terms of volume sold (prior to COVID-19 the were ranked #31).

We also developed an entirely new methodology for targeting customers, who as I mentioned earlier completely changed overnight. Consumers who had been ready to buy suddenly had to put their plans on hold, while others with no intention to buy now needed transportation. We created content directed at every permutation of this spectrum, and we will elaborate more on this strategy in a playbook we’ve developed called “Achieving Automotive Growth in 2021”. We’ll publish that in the coming weeks, and include a number of additional strategies and tactics we employed to help Murdock and other automotive clients we serve.

Insights

For the automotive sector, these changes have highlighted the role of analytics in the CMO’s role. As one major automaker’s CMO told us, “COVID-19 has accelerated shopping online, digital shopping, etc. It has also accelerated the focus on the importance of a robust analytics team that can help sort through all the data and turn it into actionable insights that drive the organization forward.”

Understanding new consumer behaviors allows dealers to anticipate what consumers are looking for and why. For example, car shoppers research heavily over a three-month period, and are ready to buy when they arrive at your door.

63% discovering their purchasing dealership online. You can’t win on the showroom floor if you don’t first win online.

81% of purchasers spend up to 3 months doing research.

71% of purchasers do not submit an online lead action (up from 39% in 2013). 41% have their first communication with you when they arrive at the store.

The car buying experience continues to evolve to be ever more consumer driven with access to pricing and inventory information available to all. By the time a consumer walks into a dealership, they are typically already at step 22 of a 25 step customer journey to purchase a new vehicle and have information down to a VIN level. The dealerships that will win in the coming years will be those that provide the best experience and service, continually imagining how to improve the journey on behalf of an ever tech savvy buying audience.

According to EY’s 2020 Mobility Consumer Index, millennials are expected to lead a car ownership boom in the next 6 months across the globe, representing 45% of all first-time car owners. The survey took place in 9 countries with more than 3,300 interviewed.

Nearly a 3rd of respondents who do not currently own a car say they plan to buy one in the next six months. “71% of non-car owners currently seeking a new car are looking to buy a gasoline or diesel model, with just 6% looking to purchase a purely electric vehicle and 23% looking to buy a hybrid,” the report said.

Other major consumer trends that dealers need to anticipate are:

Newer isn’t always better: 55% of new car shoppers consider used or CPO (up from 30% in 2016).

I’m on the phone!: 69% of shoppers will ONLY interact with your mobile site.

Search is still #1: 88% of purchasers are still searching just 3 days before purchase. And search is the #1 last step before visiting a dealership.

As dealerships enter 2021, five major opportunities exist that will keep them relevant and gainfully in business. These include:

Shifting focus to a more digital streamlined car buying process through-out the customer journey and allowing most of the interaction with the consumer to happen online and virtually.

Using video to replace the in-person visit to a dealership. Hiring a full-time videographer that can capture footage and do a vehicle walkaround of at least every model of vehicle with each trim level shown will help consumers favor a buying experience through your dealership.

Hiring sales people that are adept to digital and willing to embrace new technology in order to thrive in this new environment and consumer interactions.

Considering vehicle pricing in a much more aggressive way in your listings. Consumers can price compare and shop virtually anywhere and you are being compared to the lowest price point they are seeing for that vehicle.

Develop a cohesive omni-channel approach in order to stay in front of the consumer throughout the entire process. Most consumers will engage with up to 3 dealers in a buying experience and you want to ensure that you remain relevant and the dealer of choice. Also, utilize store visit conversions in order to know the effectiveness of your advertising by channel and promotion.

Here’s to growth, success and whatever 2021 has in store!